Capitalizing on Change: Maximizing Returns through UAE Corporate Tax 2023

Capitalizing on Change: Maximizing Returns through UAE Corporate Tax 2023

Learn how to manage the company tax registration process in the UAE and how ERP solutions may help to expedite and simplify the process. Discover the advantages of adopting ERP for company tax registration in the UAE.

All you have to know about the new UAE corporate tax to be prepared.

The United Arab Emirates (UAE) recently passed a law that sets the corporate tax rate at 9% for businesses earning taxable profits of more than AED 375,000. Businesses will be liable for UAE corporate tax at the start of their first financial year commencing on or after 1 June 2023.

It is important for organizations to take advantage of this opportunity and use UAE Corporate Tax 2023 to their advantage in order to achieve the best results. Throughout this blog, we’ll explore some important tactics and insights that can help companies navigate the UAE’s changing corporate tax environment in order to maximize profits and grow.

Understanding UAE’s 2023 Corporate Tax

In order to understand some tactics which can benefit companies during the upcoming corporate tax, lets take a closer look at UAE’s corporate tax history and what the corporate tax will be in 2023.

The History

The United Arab Emirates (UAE) has operated as a country with very low taxes for a very long time. Businesses have never paid corporate taxes, and citizens do not pay income taxes on their earnings. Most of the state’s revenue was derived from fossil fuel extraction businesses, which paid on average 50% of their earnings in taxes.

In 2018, the United Arab Emirates (UAE) became the first country to implement a VAT tax, which imposed a 5% tax on all consumer purchases. The government then addressed in January 2022 that a 9% corporate tax would be brought into effect the following year.

What is it about?

For all businesses in the UAE with profits over AED 375,000 (about $100,000 USD), the corporate tax rate will rise to 9% in 2023. Businesses with annual revenue below this threshold are not subject to taxation.

Major multinational corporations with income of more than EUR 750 million will be subject to a 15% tax in addition to the corporate tax, in accordance with the Global Minimum Corporate Tax Rate agreement.

Businesses whose financial year starts in January won’t be required to pay tax on earnings made prior to January 1, 2024.

Why do we need it?

We need the corporate tax to combat tax evasion and bring the country into accordance with international standards. The UAE’s 9% tax rate is still far lower than the average rate in most other developed countries which is often over 20% ! Some expenses may be deductible before calculating the payable tax, reducing the financial burden on taxpayers.

Role of FactsERP Software in Corporate Tax

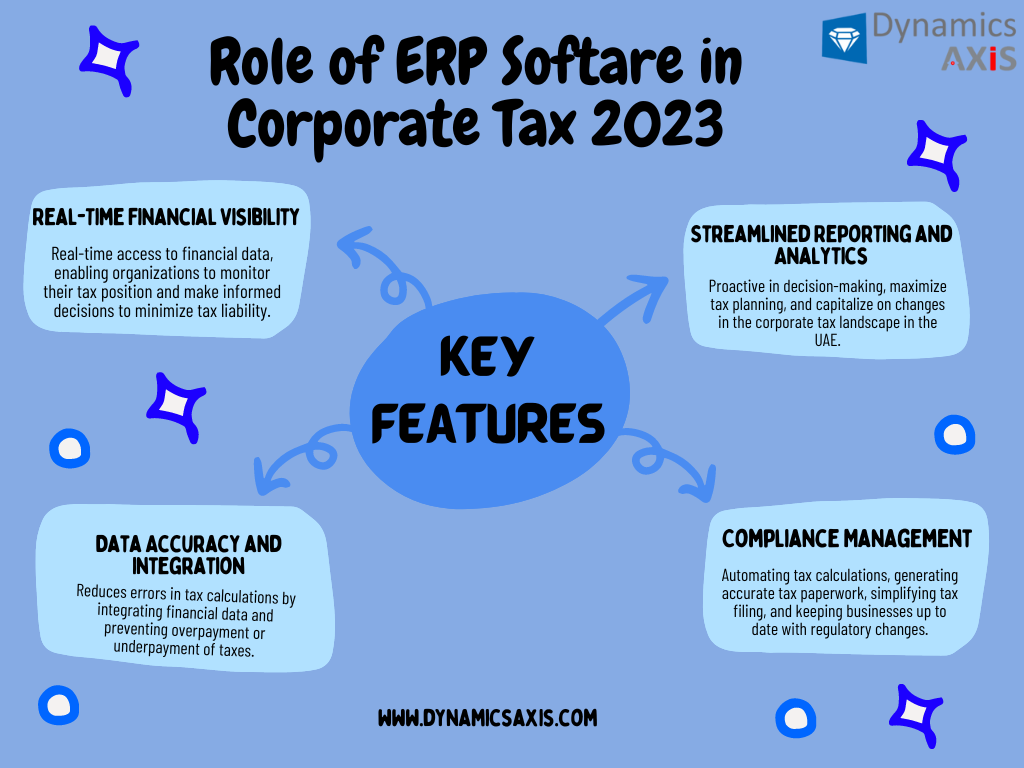

When it comes to maximizing profits and seizing opportunities in the context of UAE Corporate Tax in 2023, ERP software is essential. FactsERP system offer useful tools and features to assist tax optimization strategies and improve financial performance in light of the changing tax landscape and the necessity for businesses to react to changes. Here are some ways that FactsERP software can help you maximize profits and take advantage of changes to UAE corporate tax in 2023:

1-Real Time Financial visibility:

FactsERP software provides organizations with continuous access to financial data in real-time, allowing them to monitor their tax position. Organizations can detect possible tax savings possibilities and take well-informed decisions to minimize their tax liability thanks to this visibility.

2-Streamlined Reporting and Analytics:

FactsERP software offers advanced reporting and analytics capabilities, which are useful for taking advantage of changes in the corporate tax landscape in the UAE. Businesses can use these tools to generate detailed financial reports, examine tax information, and spot trends and patterns. By utilizing these insights, businesses can be proactive in their decision-making, maximize their tax planning, and take advantage of any new tax breaks or incentives that the UAE tax authorities may propose.

3-Data Accuracy and Integration:

FactsERP software reduces mistakes and irregularities in tax calculations by combining financial data from numerous sources, including company sales, procurement, and payroll. This accuracy ensures effective use of tax incentives and credits as well as preventing companies from paying too much or too little in taxes.

4-Compliance Management:

To avoid fines and legal problems, businesses must abide by UAE corporate tax legislation. By automating tax calculations, producing precise tax paperwork, and simplifying on-time tax filing, FactsERP software ensures compliance. We assist businesses in staying current with regulatory changes and guaranteeing compliance with UAE tax laws thanks to built-in tax rules and updated tax rates.

Conclusion

ERP software is crucial in assisting companies to improve profits and take advantage of changes to UAE Corporate Tax in 2023. FactsERP system give businesses the tools they need to successfully navigate the UAE’s tax environment, improve financial performance, and take advantage of tax-related opportunities.

Click the link below to book your free demo of FactsERP.